No One Wants to Build Anymore. So Why Not Fannie and Freddie? - #15

Fannie and Freddie as rescuers?

10 words

Housing is broken, I got an idea. It may work.

100 words

Veering away from macro current events, let’s focus on something more fundamental: housing. The U.S. housing system is structurally broken at many levels, with widespread negative effects on society. I’m not telling you anything new. But what if the solution has been right in front of us all along? What if the solution is not another demand subsidy, bold I know. Instead, what if Fannie Mae and Freddie Mac, posterboys of the 2008 housing crisis, could be the ones to help bail America out? It’s time to rethink how we use the tools already at our disposal.

1000 words

Housing as the root of of all evil (and good).

It explains why politics feel more extreme, why birth rates are falling, and why the middle class feels increasingly like a myth. And while we spend endless energy debating interest rates, subsidies, and demand-side band-aids, we continue to ignore the central issue: we don’t build enough homes.

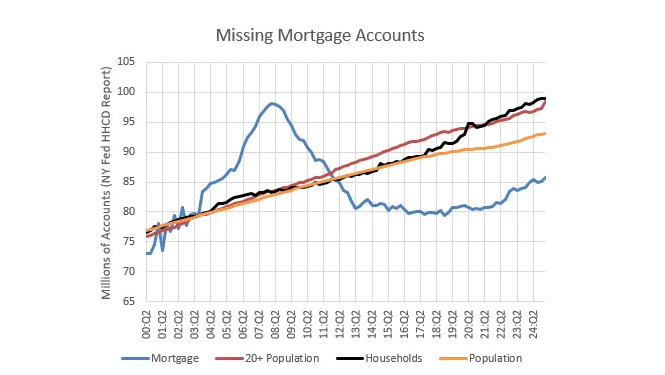

If I could choose just one chart to explain the social and economic fabric of the U.S. over the past decade, the rise of populism, the shift toward radical politics, and the widespread feeling that many Americans have of being left behind, it would be this one from Kevin Erdmann (whose Substack is an absolute goldmine if you care about housing).

How We Locked a Generation Out of Homeownership

After 2008, when mortgage underwriting standards collapsed, the pendulum swung hard in the other direction. We didn't just tighten standards, we practically criminalized mortgage lending unless you're an ultra-prime borrower. Millions of Americans who would’ve qualified pre-GFC now can’t get a mortgage at all. The result? A nation of permanent renters.

At the same time, the economics of homebuilding have gotten worse. Interest rates are high, materials are expensive, labor is scarce, and local red tape is never-ending. So builders do the rational thing: they stop building entry-level homes and focus on high-margin “Class A” products or second-time buyers with deeper pockets and stronger credit. No one wants to take razor-thin margins on a starter home when the buyer likely can’t get a loan anyway.

Why Should We Build Housing?

If the appeal of providing your fellow man with a roof over their head is not enough for your Scrooge McDuck heart, there are plenty of other reasons that housing matters.

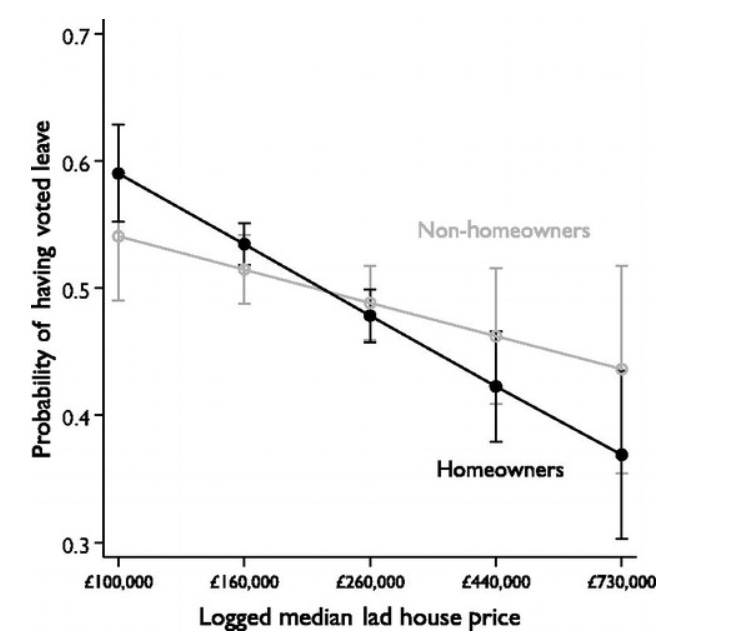

Populism is rising on both sides. Zohran Mamdani’s upset win in New York and Donald Trump’s victories in 2016 and 2024 may seem like opposites, but they share the same underlying dynamic: voters who feel like they’ve been locked out of the system. And when people don’t feel like they own anything, literally or figuratively, they’re more open to tearing it all down.

It doesn’t matter whether you're a Bushwick artist renting from Blackstone or a Detroit factory worker also renting from Blackstone (funny how that works). If you don’t own, you don’t feel like you belong.

Additionally, I would argue lack of housing is one of the primary drivers of a declining birthrate. If people can’t meet their basic needs of food, water, and shelter, they are not having kids. One great study out of Brazil looked at a mortgage lottery system where people pay into a pool and one winner each month gets funds for a home. Winners aged 20 to 25 were over 30 percent more likely to have kids. Shocking, right? Turns out people are more likely to start families when they’re not worried about where they’ll live.

Renovations to the System

There are solutions on the table already. Some are working. Others, not so much.

One good idea is upzoning. Local governments raise building height and unit limits, which allows more homes to be built. Austin did this and built more housing than the entire state of New York in recent years. They also saw rents fall. Yes, fall.

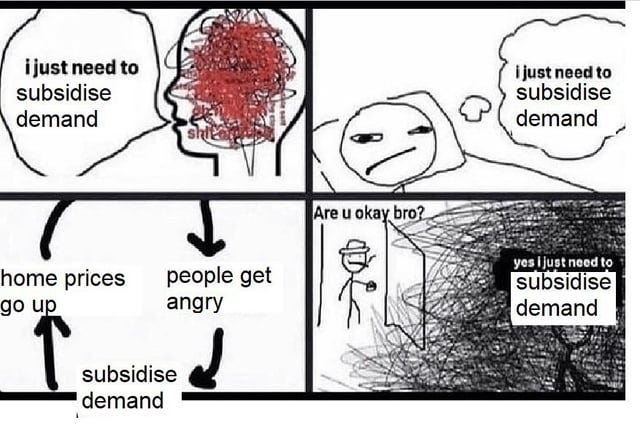

A less effective idea? Giving away money to buyers for down payments. Kamala Harris pitched $25,000 to first-generation buyers. Some states are running similar programs. But this only subsidizes demand. It doesn’t add a single new home. More money chasing the same supply just raises prices. It doesn’t really work.

The Radical Option: Fannie and Freddie as a National Homebuilder

Fannie Mae and Freddie Mac are government-sponsored enterprises that help Americans get mortgages. You might know them from headlines about potential privatization (opposite of what I am proposing) and their role in the Great Financial Crisis.

Since the financial crisis, both have been under federal conservatorship. They are profitable again, in fact, they posted nearly $29 billion in profits in 2024. That is more than enough to make them the largest homebuilder in the country by construction budget, if they used profits to build homes, ahead of giants like Lennar and D.R. Horton.

The money is there, the instituions exist, we just need to let them build.

This is not some untested fantasy. Countries like South Korea and Singapore have used this exact model. In Singapore, over 80 percent of homes are publicly developed. It can work while addressing a national problem with a national solution.

The private sector has made it clear: it will not build the affordable, entry-level homes this country desperately needs. The margins are too thin. The risks are too high. And the bureaucracy is too dense.

So if the private sector won’t do it, the public sector must.

Let Fannie and Freddie use profits to build afforable starter homes to build up the future generation of the American middle-class.

What to Do?

(Outside of campaigning for my federal homebuilder idea)

Speaking of homebuilders, these stocks screen incredibly cheap on paper, but they’re at the mercy of interest rates. With rate cuts being steadily priced out, it’s hard to see a truly bullish setup for the homebuilder index right now.

Bearish XHB 0.00%↑ (home builder index), although not outright short

Markets keep gridning higher and the bulls are firmly in control. Data like existing home sales or ADP jobs data provide some bear fodder, but it really doesn’t seem to matter. No one cares until everyone cares.

In this environment, I find it tough to be long the U.S. I prefer markets like South Korea, Germany, and Brazil for a range of reasons.

An interesting idea, but I’m afraid that it is fraught with dangers. The second the government gets involved in anything the price goes up. For example, the army pays $800 for a hammer that I can go into Ace Hardware and pick up for 15 bucks. Contractors will not try to negotiate the lowest price for supplies because they know that the money is coming from the government, so the cost of building these houses will skyrocket and, as we have seen with the auto industry, the quality does not necessarily go up at the same rate. If Freddie Mac and Fannie Mae are tasked with building the same way contractors are, then perhaps this may work, but it would require some regulatory oversight to ensure the system is not gamed.